Introduction

Financial wellness is a crucial aspect of overall well-being that encompasses not only the management of finances but also the attainment of financial goals, security, and ultimately, a sense of peace and confidence in one’s financial future. In this comprehensive guide, we’ll explore the fundamental principles of financial wellness, providing actionable steps and insights to help you achieve stability and prosperity.

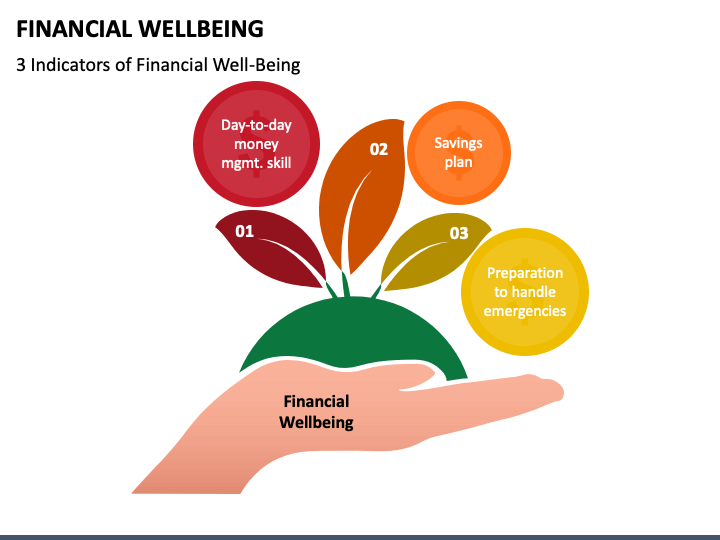

Understanding Financial Wellness

Financial wellness goes beyond the mere accumulation of wealth. It involves a holistic approach to managing resources, encompassing budgeting, saving, investing, and planning for the future. This chapter will define the key components of financial wellness and why it is essential for a balanced life.

Creating a Solid Financial Foundation

Before building wealth, one must establish a strong financial foundation. This includes creating a budget, reducing debt, and building an emergency fund. We’ll delve into practical strategies for achieving these crucial milestones.

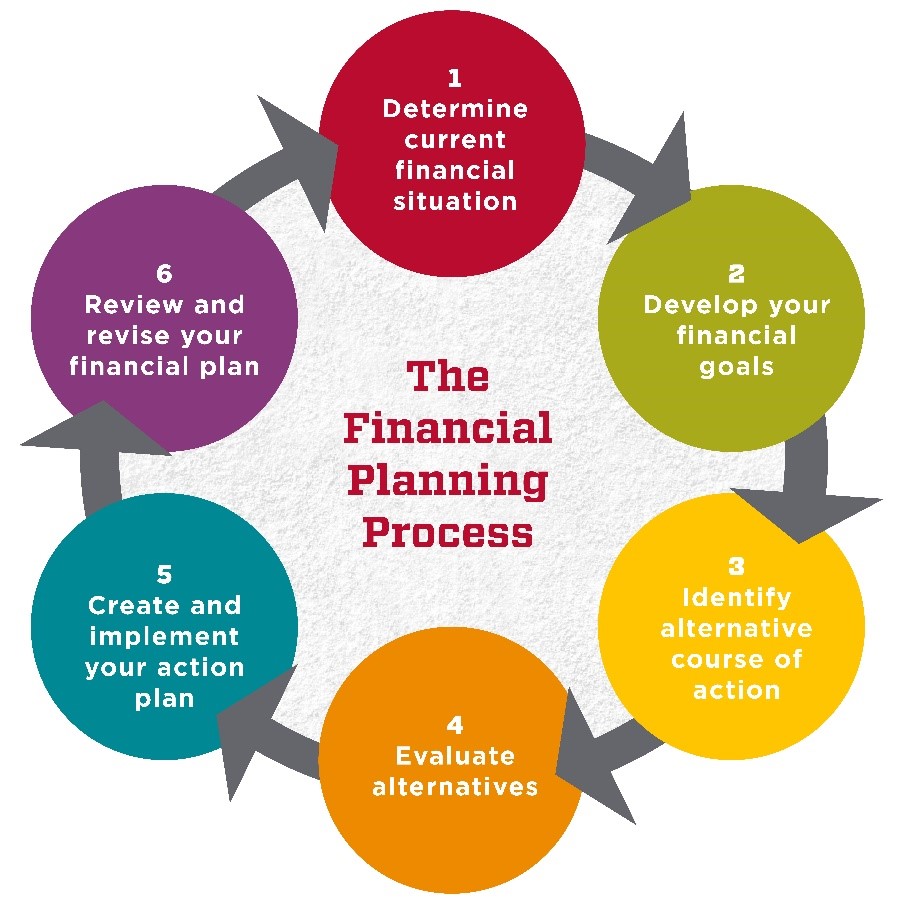

Setting Financial Goals

Clear, measurable financial goals are the cornerstone of financial wellness. This chapter will guide you in identifying short-term, mid-term, and long-term financial goals, whether it’s buying a home, saving for retirement, or starting a business.

Budgeting for Success

A well-crafted budget is the roadmap to financial success. We’ll provide actionable tips on creating a budget that aligns with your financial goals and allows for both savings and discretionary spending.

Effective Debt Management

Debt can be a significant obstacle to financial wellness. This chapter will offer strategies for managing and reducing debt, including prioritizing high-interest debts and exploring consolidation options.

The Power of Saving and Investing

Saving and investing are vital components of building wealth and achieving long-term financial goals. We’ll explore different savings vehicles, from traditional savings accounts to investment options like stocks, bonds, and real estate.

Avoid Accumulating New Debt

While repaying existing debt, it’s essential to avoid accumulating new debt. Create a budget that accounts for all expenses and allocate a portion of your income towards an emergency fund to cover unexpected costs.

Tip: Consider adopting a cash-based spending approach or using a debit card for purchases to prevent the temptation of accruing additional credit card debt.

Negotiate Lower Interest Rates

In some cases, it’s possible to negotiate lower interest rates with creditors, especially if you have a history of on-time payments. Contact your creditors and inquire about potential rate reductions.

Example: If you’ve been a loyal customer with a credit card company and have a good payment history, they may be willing to lower your interest rate.

Retirement Planning and Wealth Building

Planning for retirement is a critical aspect of financial wellness. We’ll discuss strategies for retirement savings, including employer-sponsored plans, individual retirement accounts (IRAs), and other investment vehicles.

Risk Management and Insurance

Protecting your financial well-being also involves mitigating risks. This chapter will cover the importance of various types of insurance, including health, life, property, and disability insurance.

Building Multiple Income Streams

Diversifying your sources of income can provide financial security and accelerate your path to prosperity. We’ll explore opportunities for generating additional income, such as side hustles, investments, and passive income streams.

Navigating Financial Challenges

Life is filled with financial challenges, from unexpected expenses to economic downturns. This chapter will offer strategies for weathering financial storms and emerging stronger on the other side.

Seeking Professional Guidance

Financial advisors and experts can provide invaluable insights and personalized strategies for achieving financial wellness. We’ll discuss how to select the right advisor and the benefits of professional guidance.

Monitor Your Progress

Regularly review your debt repayment plan to track progress and make adjustments as needed. Celebrate milestones, no matter how small, to stay motivated.

Example: Create a visual representation of your debt repayment journey, such as a chart or graph, to track your progress and visually see your debt decreasing over time.

Conclusion

Achieving Financial Wellness is a dynamic and ongoing journey that requires commitment, knowledge, and prudent decision-making. By implementing the principles and strategies outlined in this guide, you can take significant steps towards attaining stability, security, and prosperity in your financial life. Remember, financial wellness is not about achieving perfection, but about making informed choices that align with your goals and values. Start your journey towards financial wellness today!