What is a Summary Judgment Motion in a Foreclosure Case?

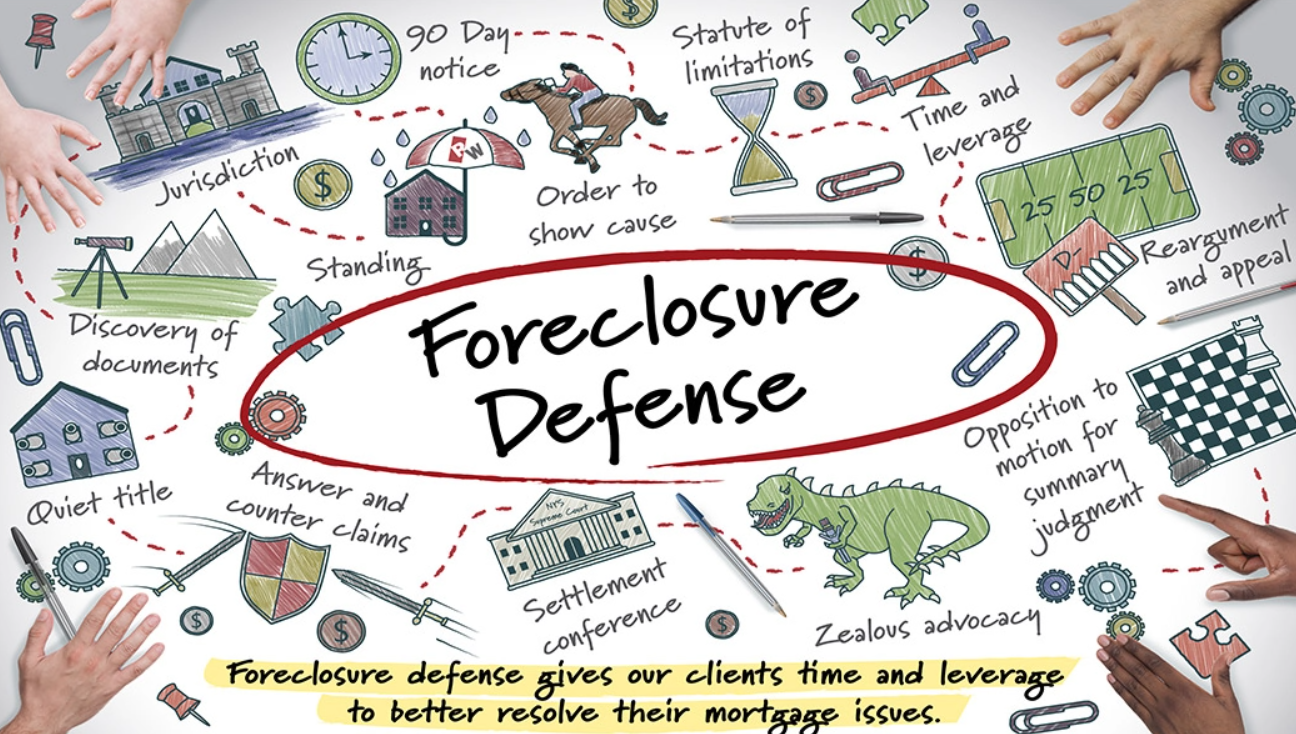

If you live in New York, and are going through the foreclosure process, there are a number of terms you are going to come across. The Motion for Summary Judgment is usually the main motion in a foreclosure case, and how it goes in terms of what it says, how it is defended, and how it is decided will determine the course of your foreclosure case.

What Is a Motion for Summary Judgment?

Trials for an entire foreclosure case are unusual since foreclosures are usually disputed over the law and not the facts – which are mostly determined based on documentation, notes, mortgages, assignments, modifications, payment records, notices, and filings.

With a Motion for Summary Judgment, the Plaintiff (your lenders or whoever is foreclosing on your property) asks the Court to resolve your case without a trial. If the Plaintiff feels that they can give the Court all the facts of your case (supported by affidavit, by a copy of the pleadings and by other available proof, such as depositions and written admissions – N.Y. C.P.L.R. § 3212), then there is no need to bring in a jury to dispute the case and the Judge should find for the Plaintiff. If your lender’s motion summary judgment is granted by the Judge, this means that the Court will allow your foreclosure to go through without delay.

How to Get Ahead of a Summary Judgment Motion in the First Place

With the right foreclosure lawyer, you may be able to mount an offensive against your lenders before they even get to the motion for summary judgment phase. For example, N.Y. C.P.R.L. 3211 permits a motion to dismiss a foreclosure action due to any of the following circumstances:

- A defense is found upon documentary evidence

- The court does not have jurisdiction over the cause of action

- There is no legal capacity to sue

- Bankruptcy has discharged the debt

Talk to your foreclosure attorney and make sure that you’re proactively ahead of your lenders. You should be responding to all legal notifications (also called answers), you should make every meeting and conference, and you should have your foreclosure lawyer at your side through it all.

How to Fight a Motion for Foreclosure Summary Judgment

A motion for summary judgment tends to be made after any pleadings and foreclosure settlement conferences have closed and your lender feels that there are no further reasons to delay. If you do not try to defend this motion, the Court will more than likely grant a default judgment to your lenders. The step after that is a Motion for an Order of Reference, the goal of which is for the Court to appoint a referee to compute the total amount you owe your lenders and to conduct a foreclosure sale.

However, you as a defendant have a right to a trial if there are contested factual issues. When a judge determines a trial is required it is usually over a very specific issue, and not over the overall and broader foreclosure case. Issues that could potentially be the focus of a court ordered one-issue “trial” are the following: i) 90-day notice, ii) proof of standing, iii) proof of good service of process, or iv) proof of possession of original loan documents.

For example, your lenders have the burden of proving they are entitled to a summary judgment by showing sufficient documentary evidence, including an affidavit of the facts by someone with knowledge of them. Your foreclosure lawyer might challenge the supporting documents because a loan often changes hands between multiple lenders during the course of its term. Your lender will seldom produce affidavits from each individual lender or servicer with direct knowledge of the facts. So, if your lender produces an affidavit from the third loan servicer who held your loan, this servicer cannot testify to the facts of a loan modification submitted to the first loan servicer because they lack direct knowledge of those facts. If this is essential to the case, it may result in the court denying summary judgment.

If your lenders lose at trial, they usually get another opportunity to get the documents they needed together. But if their case is dismissed altogether, your lenders will have to begin all over and start a new case against you. This gives you and your foreclosure lawyer time to try and open negotiations again.

If your lenders win their case at trial, the case against you will progress. You and your foreclosure attorney can try to reargue or appeal, but unless there is a stay, the foreclosure process will continue. This means your lenders will ask the court to assign an independent Referee (a Motion for an Order of Reference) who will determine how much your property is worth (a Report of Amount Due) so they can claim your home and sell it at auction (a Judgment of Foreclosure and Sale).

What to Do Next

If your lenders have sent you documentation mentioning foreclosure, reach out to New York foreclosure lawyer Ronald Weiss immediately. After a free consultation, he can tell you what you need to know about fighting a foreclosure lawsuit and help you get your case started. Call 631-203-1730 and take the first step to a fresh start.