Introduction

In the age of digitalization, many aspects of our lives have been simplified, including shopping and financial transactions. However, with convenience often comes a dark side, and in this case, it’s the rise of fake receipt generator and makers. These online tools may seem harmless at first glance, but they pose significant risks, both legally and ethically. In this blog, we’ll explore what fake receipt generators are, how they work, and why using them can have serious consequences.

What are Fake Receipt Generators and Makers?

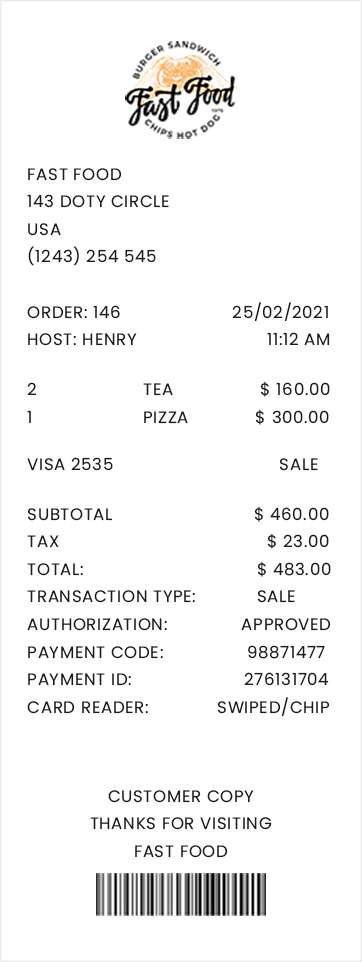

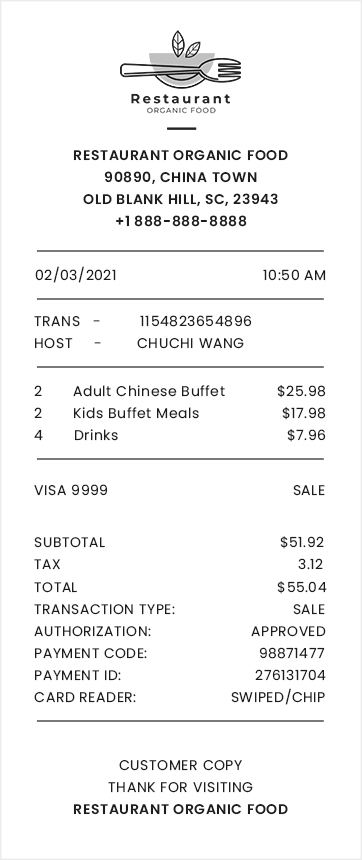

Fake receipt generators and makers are web-based tools or software programs designed to create counterfeit receipts for various purposes. These receipts can mimic the appearance of legitimate transaction records from businesses, showing items purchased, prices, and other details. While some individuals may use these tools for harmless pranks or as a novelty, others exploit them for fraudulent activities such as tax evasion, expense fraud, or even to support illegal activities.

How Do Fake Receipt Generators Work?

Fake receipt generators typically operate as simple web applications or software programs that follow a few common steps:

- Input Information: Users input the details they want to appear on the fake receipt. This includes the name and address of the business, transaction items, quantities, prices, dates, and more.

- Generate Receipt: Once the required information is entered, the tool generates a counterfeit receipt that closely resembles a genuine one. Some tools even provide customization options to make the receipt look more convincing.

- Download and Print: Users can then download the fake receipt as a digital file or print it out to use for their intended purpose.

Why Are Fake Receipts a Problem?

- Legal Consequences: Creating and using fake receipts is illegal in many jurisdictions. It can lead to criminal charges, fines, and even imprisonment. Tax authorities, businesses, and law enforcement agencies take such offenses seriously.

- Ethical Concerns: Fraudulent activities harm businesses and consumers alike. Using fake receipts to evade taxes or seek reimbursement for non-existent expenses is dishonest and unethical.

- Impact on Businesses:Fake Receipt Maker can hurt businesses by distorting financial records, leading to inaccurate tax filings, and potentially damaging their reputation.

- Risk to Personal Finances: Those who use fake receipts to inflate expense claims or underreport income may face financial consequences when caught, including penalties and interest.

- Diminished Trust: The prevalence of fake receipts erodes trust in financial transactions and creates a culture of dishonesty, ultimately impacting society as a whole.

Conclusion

While the digital age has brought many conveniences, it has also given rise to unethical and illegal practices such as fake receipt generation. It’s crucial for individuals and businesses to recognize the risks and consequences associated with using these tools. Instead of resorting to dishonest practices, it’s always better to maintain integrity in financial matters and abide by the law. The repercussions of using fake receipts far outweigh any potential short-term gains, and it’s essential to consider the long-term consequences of such actions. Society benefits when individuals and businesses operate with honesty and transparency in all financial dealings.