Introduction to Salary Slip

Salary slip is a statement of income and deduction is an important document drawn up by the employer and distributed to the employees monthly. It is the report of income and deductions of the employee by which the employees are facilitated to file the tax, get loans, and make their finances ready. The payroll teams are obligated to draw up efficient, regulatory, and legible salary slips.

Why Salary Slip is Important

Salary slips are not just a document—they give the employee full monetary disclosure. For this reason alone, they are valuable:

- Proof of Income – For loans, visas, and credit cards.

- Tax Submission – Allows employees to pay tax in the right manner.

- Employment Confirmation – Employers use a legally binding employment confirmation.

- Compliance with the Law – Complies with labor legislations and payroll legislation.

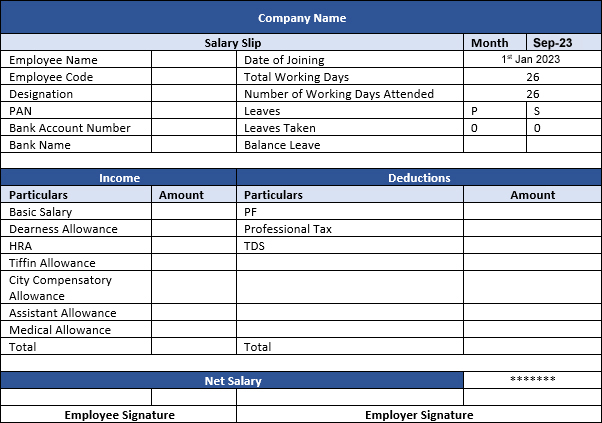

Summary of Information in Salary Slip

All the information needed should be included in the salary slip template in order to maintain clarity to the employees as well as fulfill compliances to the payroll members. The needed information includes:

- Employee Information: Name, employee number, job title, department.

- Employer Information: Company name, address, tax registration information.

- Payroll Date: Pay year and month.

- Salary/Income: Basic salary, House Rent Allowance (HRA), allowance, bonus.

- Adjustments: Employee State Insurance (ESI), Provident Fund (PF), TDS, professional tax.

- Net Salary: Amount credited to employee’s bank account.

Mode of Payment: Cheques, remittance through bank, cash.

Break-up of Income (Basic, HRA, Allowances, Bonuses)

A pay slip of salary has numerous parts of income, i.e.:

1. Basic Salary

That part of an employee’s salary which is on fixed scale and upon which salary need to be calculated.

2. House Rent Allowance (HRA)

Deductions are made for payment of rent. HRA is exempted mostly under the income tax act.

3. Special Allowances

Conveyance allowance, food allowance, medical allowance, etc., which are taxable.

4. Bonus & Incentives

Performance incentive, festival bonus, annual incentive, and all of them can be exempted from tax.

Deductions (PF, ESI, Professional Tax, TDS)

There are deductions too on a salary slip, and these determine an employee’s net pay. These are usual deductions:

1. Provident Fund (PF)

Both employer and employee contribute equal basic salary amount into the retirement fund scheme.

2. Employee State Insurance (ESI)

Paid deduction for the employees who earn less than some amount of money, with the health insurance coverage.

3. Professional Tax

Salaried employees’ state tax differs according to the states of India.

4. Tax Deducted at Source (TDS)

portion of the income tax withheld by the employer from the salary before payment to the workers

Gross vs. Net Salary

Gross Salary = Basic salary + HRA + Allowances + Bonuses

Net Salary (Take-Home Salary) = Gross Salary – Deductions (PF, ESI, TDS, etc.)

Illustration:

Profit Salary = ₹50,000

Total Deductions = ₹5,000

Net Salary = ₹45,000 (bank credited)

Format Differences between Different Companies

Various organizations have various salary slip formats depending on their payroll section. They may be:

- Corporate Organizations – Long-format salary slips with various allowances and benefits.

- Startups & Small Organizations – Easy salary slips with minimal salary and deduction information.

- Government Institutions – Salary slips with extra columns such as DA (Dearness Allowance) and pension contribution.

How Payroll Departments Ensure Accuracy in Salary Slips

Payroll offices become the primary supporting columns in providing proper salary slips through automating with:

Automated Payroll Software – Prevention of errors in calculating salaries.

Accurate compliance with Labour Law – Accurate deductions compliance.

Swift Processing of Salaries – Swift processing of salaries.

Processing Inquiries of Employees – Difference in salary items solution.

Online or Printed Salary Slips – Advantage & Disadvantage

Conclusion: Salary slips are more convenient and secure online, although some employees may appreciate printed slips as a facility for maintaining a record.

Free Salary Slip Templates for HR Departments

The HR department can utilize pre-formatted salary slip templates to process payroll with ease. Downloadable templates are:

- Excel Salary Slip Format – Easy and convenient to modify and use.

- PDF Salary Slip Template – Printable in a professional format.

- Word Salary Slip Format – Can be created with company branding.

Transparency in the Payroll System

Transparent pay system is advantageous for both the employers and the employees. Here’s why:

- Clear Salary Slip Format – Keeps the employees informed about their salary and deductions.

- Salary Processing on Time – Encourages trust and increases employee satisfaction.

- Payroll Software Integration – Reduces errors and compliance is enhanced.

- Employee Self-Service Portals – It assists the employees in downloading the salary slips on a periodic basis, as per their suitability.

Conclusion

Salary slip is a very finance-related document that is beneficial to both the employees and the employers. If the payroll slip structure is standardized, then the process turns out to be error-free, transparent, and easy to monitor the salary. In designing an improved payroll system, accuracy, mechanized procedure, and convenient accessibility should be in the payroll section’s mind. In preparing the payroll and budgeting properly, it’s good to examine the payroll slip either from an employee’s perspective or the HR point of view.