HRA : House Rent Allowance

HRA full form – House Rent Allowance (HRA) is part of maximum workers’ pay packages. HRA isn’t always absolutely taxable, although it is part of your salary. A part of HRA is excluded from taxation below Section 10 (13A) of the Income Tax Act of 1961, challenge to a few provisions.

Until calculating taxable profits, the sum of HRA exemption is deducted from the general profits. Which permits an person to shop cash on taxes and House rent allowance calculation

However, endure in thoughts that if an worker lives in his or her personal domestic and does now no longer pay hire, the HRA accumulated from his or her agency is absolutely taxable.

Tax Exemption from HRA

The sum that have to be deducted is the least of the following:

The real HRA received;

50% of [basic salary+DA] for those residing in metro cities [40% for non-metros];or

Actual hire paid much less than 10% of primary salary + DA

Who can avail HRA?

This tax incentive is handiest relevant to salaried human beings who’ve an HRA component in their pay shape and stay in apartment housing. The allowance isn’t always to be had to self-hired workers.

HRA for the Self-Employed

Employed personnel can also declare HRA. You can declare the blessings below 80GG, and this phase also can be applied to assert HRA tax exemptions via way of means of the salaried after they don’t get HRA.

Special HRA Claims

The person searching for the tax exemption can’t personal the apartment premises. So, in case you stay together along with your dad and mom and pay the hire, you may say HRA deduction. You, on the alternative hand, are not able to manage to pay for your spouse’s hire. Since you’re anticipated to take the housing collectively in phrases of your friendship.

As a result, the Income-tax Department will scrutinize those transactions.

And in case you are renting the residence out of your dad and mom, make certain you’ve got got documentary proof that your tenancy entails economic transfers among you and your dad and mom. So preserve music of your economic transactions and hire receipts due to the fact the tax branch might also additionally deny your argument if the transactions’ validity is questioned. The Mumbai profits tax appellate tribunal lately disregarded a salaried taxpayer’s HRA petition due to the fact the declare did now no longer appear legitimate to the tax officials.

If your private home is leased out otherwise you stay in any other place, you’ll take gain of the simultaneous cost of a reduction for the house mortgage against ‘hobby charged’ and ‘foremost repayment’ in addition to HRA.

How to Calculate HRA?

HRA is an vital a part of a character’s repayment package. The cumulative quantity allotted via way of means of the agency for the worker’s housing is known as hire. The sum set apart for HRA is beneficial to personnel whilst it’s far used to degree tax deductions for a sure financial year.

HRA will even assist you shop cash via way of means of decreasing your taxable taxes.

The tax incentives related to HRA are handiest to be had to salaried individuals who stay in rented housing. An worker who lives in his or her personal domestic isn’t always entitled to record the stability as a tax deduction.

HRA is calculated primarily based totally on a lot of considerations, which include the worker’s proper to 50% of his or her minimal salary if she or he lives in a metro town and 40% if she or he lives in both of the alternative cities.

The following 3 provisions are taken into consideration whilst calculating HRA for tax purposes:

The actual hire does now no longer exceed 10% of the minimal salary.

If you stay in a metro, you’ll acquire 50% of your minimal salary, and in case you stay in a non-metro area, you’ll acquire 40%.

The HRA quantity that the agency has allotted.

Example of HRA Calculation:

Consider the state of affairs of Mr. Shiva, a salaried character who lives in Mumbai. He will pay a month-to-month hire of Rs.10,000 for his leased accommodation. This equates to Rs.1.2 lakh in keeping with year. His month-to-month income as visible with inside the desk below:

Per month, he has a PF of Rs.2,000 and a technical tax of Rs.two hundred deducted from his pay.

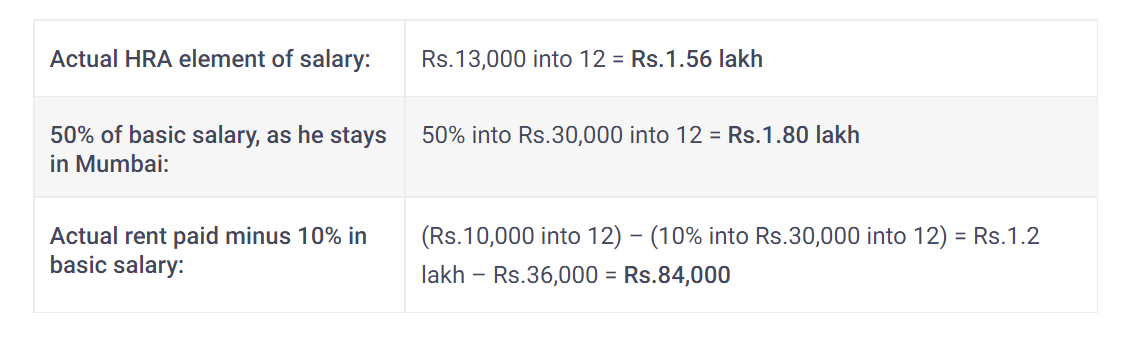

In Mr. Shiva’s case, the tax-unfastened part of his HRA could be the bottom of the following, primarily based totally on his annual income:

| Basic Salary | Rs.30,000 |

| HRA | Rs.13,000 |

| Conveyance Allowance | Rs.2,000 |

| Special Allowance | Rs.3,000 |

| Leave Travel Allowance (LTA) | Rs.5,000 |

| Total Earnings | Rs.53,000

|

Mr. Shiva will acquire Rs.84,000 in tax exemption on HRA in view that it’s far the bottom cost above. The the rest of his HRA could be taxed in step with his profits tax bracket.

Benefits of HRA

The actual hire you pay should be much less than 10% of your month-to-month salary.

The sum of HRA that your boss has given you.

If you stay in a metro, you’ll get 50% of your base profits, and in case you stay anywhere, you’ll get 40%.

Eligibility

It is handiest given to personnel whilst an worker honestly will pay hire to the landlord.

Apart from the father, if the hire is commonly paid via way of means of any other member of the family HRA and its tax blessings are furnished to that worker.

Required Documents for HRA Deduction

Leasing certificate and apartment agreements are the maximum vital files to encompass whilst soliciting for a tax deduction for HRA.

And in case you pay hire on your dad and mom, as a taxpayer, you may be responsible for this deduction.

To get a tax deduction on HRA, you’ll want to use your hire receipts as a taxpayer.

In conditions in which the once a year hire of the housing unit reaches Rs.1 lakh, the landlord’s/PAN landlady’s should additionally be given.

If the landlord/landlady does now no longer have a PAN passport, she or he have to have a self-announcement with the identical information.