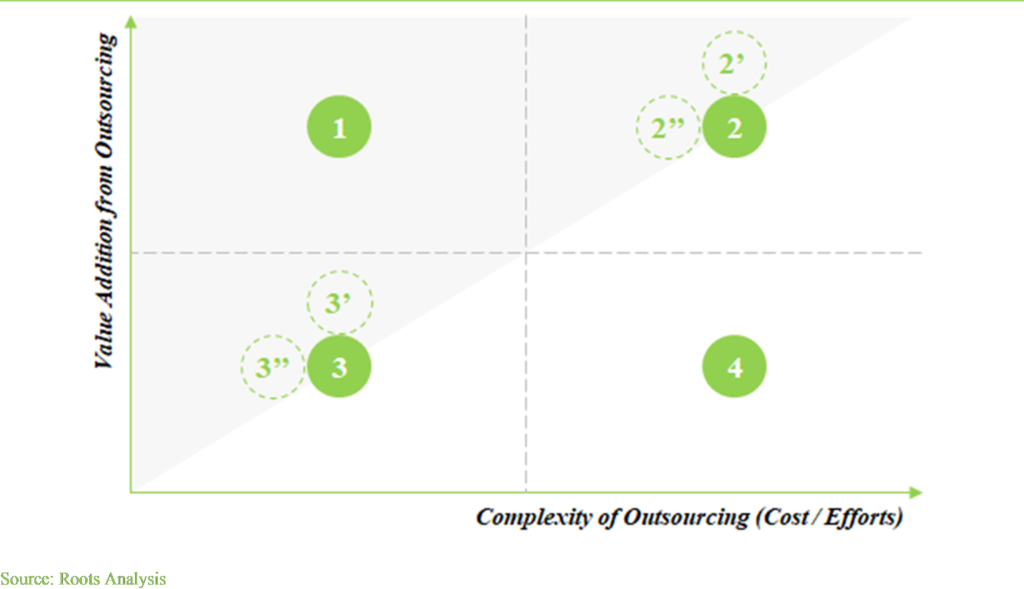

Given the growing preference for outsourcing in the pharmaceutical industry, it is imperative for stakeholders to be able to draw a distinction between making a product (insourcing) or buying it from a third-party supplier (outsourcing). The same paradigm is applicable to services as well. Over the last few decades, there has been a lot of research on the make-or-buy decision, mostly focusing on how different companies tend to make the right decision in this regard. In fact, many experts believe that the thinking in this direction has evolved at a very rapid pace. Interestingly, a significant body of evidence favoring the outsourcing option has been generated from the aforementioned studies. Presently, we are led to believe that a detailed review of existing approaches and decision-making frameworks may help establish a better understanding of this process.

Example illustrating Scenario 1:

In December 2019, Asymchem and Taizhou EOC Pharma entered into a manufacturing and supply agreement. Key highlights related to the agreement are as follows:

- The CDMO, Asymchem, agreed to offer drug development, production and regulatory support services to Taizhou EOC Pharma.

- As Asymchem’s manufacturing facility in located in China as well, it is likely to provide additional regional capacity to Taizhou EOC Pharma for its products.

- Further, Asymchem claims to have an experience of 25 years and the required technical expertise to cater to Taizhou EOC Pharma’s oncology-related drug development needs.

In this scenario, it is safe to assume that the complexity of outsourcing is less, considering that Taizhou EOC Pharma, a Chinese company is engaging Asymchem, which is also based in the same region. In other word, the concerns associated with linguistic / sematic and logistics-associated barriers, are not applicable in this particular deal.

Example illustrating Scenario 2:

In January 2017, Enteris BioPharma entered into the manufacturing and supply agreement with KeyBioscience (a subsidiary of Nordic Bioscience). Key highlights related to the agreement are as follows:

- The CDMO, Enteris BioPharma agreed to assist in the GMP manufacturing of KeyBioscience’s metabolic peptides, by utilizing its proprietary technology Peptelligence.

- Further, the adoption of the innovative technology (Peptelligence) by KeyBiosciences is expected to add substantial value to its capabilities.

- Since Enteris BioPharma is located in the US, it presents an opportunity for KeyBiosciences to expand the geographical reach of its products.

In this scenario, complexities are mainly subjected to logistic and language barriers since KeyBioscience is headquartered in Denmark, while Enteris BioPharma is based in the US. However, adoption of a novel production technology is anticipated to add high value to KeyBioscience in the long term, and could be a plausible reason to outsource the operations.

Example illustrating Scenario 3:

In August 2018, Dalton Pharma, a CDMO, entered into a manufacturing and supply agreement with Arch Biopartners. Key highlights related to the agreement are as follows:

- The CDMO, Dalton Pharma, agreed to assist Arch Biopartners in the cGMP manufacturing and fill / finish for metablok.

- It can be presumed that, through this agreement, Arch Biopartners gained access to fill / finish capabilities.

In this scenario, the rate of complexity is low, as both Dalton Pharma and Arch Biopartners are located in same geography, thus eliminating any concerns associated with logistic and linguistic barriers.

Example illustrating Scenario 4:

Eli Lilly is the developer and manufacturer of peptide drug Trulicity[5] and in order to build on its capabilities, the company has undertaken certain recent initiatives. In October 2019, Eli Lilly entered into collaboration with Centre for Process Systems Engineering (CPSE) to develop an innovative approach for liquid phase peptide synthesis. The novel technology is anticipated to be more efficient than conventional technologies. Moreover, we could interpret that the adoption of a novel technology is likely to add value to the company’s capabilities, thereby, further facilitating in-house production of peptide drugs. In the subsequent month, Eli Lily announced its plan to expand its manufacturing capabilities at the Lilly Technology Center campus in Indianapolis, US through an investment worth USD 400 million. The expansion is likely to accommodate additional manufacturing capacity for diabetes drugs, including Trulicity. Since, Eli Lilly have adequate amount of funds and resources to expand in-house capabilities we could infer that it is likely to omit outsourcing of its products in the near future. Therefore, more of such initiatives led by the big pharma players often results in minimizing the requirement of outsourcing.