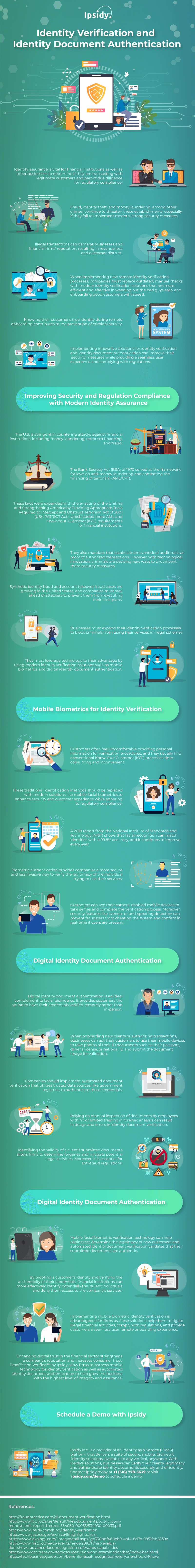

Monetary gain is often the motivation of criminals when attempting to infiltrate financial institutions, committing identity theft, money laundering, data breaches, and account fraud. These illegal activities have a massive impact on businesses and banking firms’ reputation and result in costly consequences, such as reduced profits and loss of client trust.

Therefore, to avoid such consequences, financial firms need to employ necessary security protocols for identity verification when onboarding clients and before authorizing a transaction. Deploying identity authentication processes will ensure banking organizations that they are transacting with legitimate customers.

Institutions do not only implement identity proofing to ensure that the person accessing their services is the legitimate identity owner. Instead, they also employ these verification processes to counter criminals’ illegal activities and comply with regulations, such as the Anti-Money Laundering (AML) and Know Your Customer (KYC).

However, with the continuous innovation in digital technology, the KYC process and other conventional identity verification methods are inadequate in deterring fraudulent identity threats, significantly when firms and customers shift to using digital channels for their transactions. Cybercriminals have seen the shift to electronic banking as an opportunity to develop more sophisticated and malicious techniques to infiltrate financial networks for their fraudulent activities.

A report from Javelin Strategy and Research has indicated that the total identity fraud has reached $16.9 billion in 2019, and there was a 79% rise in account takeover fraud. Accordingly, the Federal Trade Commission has specified that synthetic identity fraud is the fastest-growing type of identity theft in the US, constituting about 80-85% of identity fraud cases.

Companies need to replace outdated, manual checks with modern verification solutions when implementing new remote identity authentication processes. Employing innovative solutions for identity verification and identity document authentication can improve a financial organization’s security measures, provide a seamless user experience to their clients, and comply with regulations.

The Federal Financial Institutions Examination Council (FFEIC) recommends that banking organizations use multi-factor authentication solutions as the process involves the use of two or more of the following verification criteria: something you have (token or smart card); something you know (password or PIN); and something you are (biometrics).

Biometric identification solutions offer a more secure and less invasive identity verification process. Furthermore, facial biometrics support omnichannel customer identification and ensure businesses that they are transacting with legitimate clients. These modern authentication solutions are more efficient and effective in weeding out the bad guys early and onboarding good customers with speed.

The US is rigorous in countering attacks against financial institutions, thus creating laws on anti-money laundering and combating the financing of terrorism (AML/CFT). The PATRIOT Act has also been enacted to improve security and regulation compliance of banking organizations. This infographic from Ipsidy provides more details about the importance of identity verification and identity document authentication.